China is in trouble:

China Beige Book Reveals Employment Plunges To 4-Year Low, Capex Worst In History

Which basically explains that the Chinese are having problems paying some of their debts and are having to lay off workers, that are rebelling.

This has gone far enough that a prominent news source produced a letter asking Xi Jinping to step down. The Chinese Communist party is doing its best to find the writer of the letter by doing things such as 'disappearing' people and arresting them without trial.

This has gone far enough that a prominent news source produced a letter asking Xi Jinping to step down. The Chinese Communist party is doing its best to find the writer of the letter by doing things such as 'disappearing' people and arresting them without trial.

I.e. they are responding to an potential social unrest, tyranically.

The big catalyst for the August 2015 crash was a Yuan devaluation:

Now there is more devaluation:

On top of this, energy stocks are taking a pounding with the Price/ Equity ration, how much price per share. Shooting up to twice as much value per stock to income for that stock than there has ever been at least since 1960's:

Perhaps this is because Da'esh has lost Raqqa? (Oil revenue!)

And there is tremendous upward pressure on the VIX. Which is one of the most important indicators of when stock is going to crash.

Which sometimes happens when a "terrorist" attack is going to happen.

So one or the other really. But taken together there should at least be some wobble in the stock market.

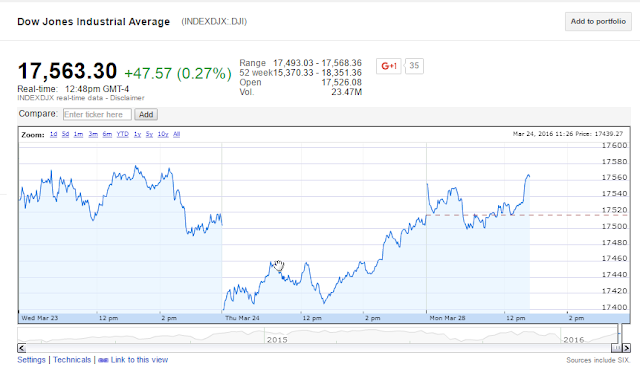

Of course though, that would mean stocks pay attention to reality, which is ridiculous, here is the DOW as of this moment:

Update a few hours later,

There has been yet another devastating piece of evidence that seems to doubt the fact the stock market should be doing anything but crumbling, and past information I remember makes the case for its fall even stronger,

Perhaps I'll write a whole new post on it, for the moment, I'll just say this and anyone need only follow Zerohedge to have these articles show up!

Another edit... Oh go on then, here's what I'm talking about:

YTD Corporate Default Jump To Highest Since 2009

Also, that corporate buybacks are the reason the stock is growing (customers buying back their own stock) and the smart money is dumping.

No comments:

Post a Comment